How to compare rental car insurance policies – Navigating the world of rental car insurance policies can be a daunting task, but it doesn’t have to be. By understanding the key differences in coverage, deductibles, exclusions, and additional options, you can make informed decisions that protect you and your wallet. Here’s a comprehensive guide to help you compare rental car insurance policies and choose the best coverage for your needs.

Key Coverage Differences

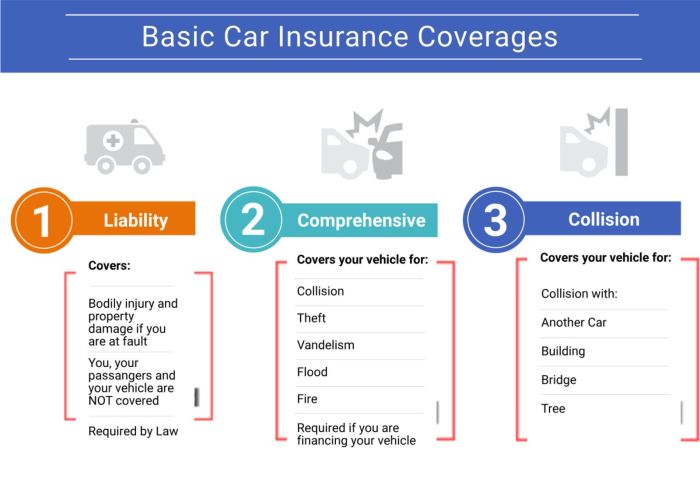

When comparing rental car insurance policies, it’s crucial to understand the types of coverage offered and how they differ. These policies typically provide a range of coverage options, including collision damage waiver, liability coverage, and personal accident insurance.

The key differences between these coverage types lie in the level of protection they provide. Collision damage waiver covers damage to the rental car, while liability coverage protects against financial responsibility for injuries or property damage caused to others. Personal accident insurance, on the other hand, provides coverage for medical expenses and lost income in case of an accident.

When comparing rental car insurance policies, it’s essential to consider factors like coverage, deductibles, and additional protection options. Similar to car insurance , rental car insurance policies vary in terms of coverage and cost. By carefully evaluating the terms and conditions of different policies, you can ensure that you have the right coverage for your specific needs and budget when renting a car.

Collision Damage Waiver, How to compare rental car insurance policies

Collision damage waiver (CDW) is an optional coverage that waives the renter’s financial responsibility for damage to the rental car in the event of an accident. It’s important to note that CDW does not cover personal belongings or damage to other vehicles.

To make an informed decision, it’s essential to compare rental car insurance policies. Consider coverage options, deductibles, and any additional costs. For a comprehensive overview of rental car insurance costs, refer to How Much Does Rental Car Insurance Cost: A Comprehensive Guide.

By understanding the financial implications, you can select a policy that aligns with your specific needs and provides adequate protection during your rental period.

Liability Coverage

Liability coverage is required by law in most states and protects the renter against financial responsibility for injuries or property damage caused to others while driving the rental car. The coverage limits vary depending on the policy, so it’s important to choose a policy with adequate limits.

Understanding how to compare rental car insurance policies can save you money and ensure you have adequate coverage. Consider factors such as policy limits, deductibles, and additional coverage options. If you’re planning to rent an electric car, it’s crucial to research Electric Car Insurance Costs in 2025: A Comprehensive Guide to understand the potential costs and coverage differences compared to traditional vehicles.

This will help you make informed decisions when choosing a rental car insurance policy that meets your specific needs and budget.

Personal Accident Insurance

Personal accident insurance provides coverage for medical expenses and lost income in case the renter is injured in an accident while driving the rental car. This coverage is optional and typically has a lower coverage limit than liability coverage.

When comparing rental car insurance policies, it’s important to consider the level of coverage you need. If you’re planning a road trip in a high-performance vehicle like the Ford Mustang Mach-e Gt , you’ll want to make sure you have adequate protection in case of an accident.

Comparing different policies can help you find the best coverage at the most affordable price.

Deductibles and Premiums

Deductibles and premiums are two key factors that determine the cost of rental car insurance. A deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Premiums are the regular payments you make to your insurance company to maintain your coverage.

The higher your deductible, the lower your premium will be. This is because the insurance company is taking on less risk by having you pay more out of pocket. Conversely, the lower your deductible, the higher your premium will be. This is because the insurance company is taking on more risk by having to pay more if you have an accident.

Comparing rental car insurance policies requires careful consideration of coverage, deductibles, and additional options. Understanding the nuances of each policy ensures you have adequate protection while minimizing unnecessary expenses. As the automotive landscape evolves, electric vehicles are gaining traction, and their affordability is expected to surpass gasoline vehicles by 2025.

Cost of Electric Cars in 2025: Poised to Surpass Gasoline Vehicles provides insights into this transformative trend. By weighing the benefits and costs of electric vehicles against traditional options, you can make informed decisions when renting a car.

Factors that Influence Deductible and Premium Rates

Several factors can influence the rates of deductibles and premiums, including:

- Your age

- Your driving record

- The type of car you’re renting

- The length of your rental

- The location where you’re renting

It’s important to compare deductibles and premiums from different insurance companies before you purchase a policy. This will help you find the best coverage at the best price.

When comparing rental car insurance policies, it’s essential to consider who is liable in the event of an accident. Understanding the responsibilities of both the renter and the rental company can help you make an informed decision. For a comprehensive analysis of this topic, refer to our article Whos on the Hook in a Rental Car Accident?

. This guide provides valuable insights into the legal framework surrounding rental car accidents, empowering you to choose the insurance policy that best protects your interests.

Exclusions and Limitations

Rental car insurance policies often have exclusions and limitations that restrict coverage in certain situations. Understanding these exclusions is crucial to avoid unexpected expenses in the event of an accident or other covered incident.

Common exclusions include:

Damage to the Rental Car

- Intentional or reckless driving

- Driving under the influence of alcohol or drugs

- Using the rental car for illegal activities

Liability Coverage

- Injuries or damages caused to the driver’s family members or household members

- Bodily injury or property damage caused while the rental car is being used for commercial purposes

- Liability coverage may be limited to a specific amount, which may not be sufficient to cover all damages

Personal Belongings

- Theft or damage to personal belongings left in the rental car

- Coverage for personal belongings may be limited to a specific amount

It’s important to carefully review the policy document to understand the specific exclusions and limitations that apply to your rental car insurance policy. By doing so, you can make informed decisions about the coverage you need and avoid surprises in the event of an accident or other covered incident.

Additional Coverage Options: How To Compare Rental Car Insurance Policies

Rental car insurance policies often provide additional coverage options that can enhance the level of protection provided. These options may include roadside assistance, personal effects coverage, and gap insurance.

Roadside assistance provides coverage for unexpected events such as flat tires, dead batteries, and lockouts. This coverage can be particularly valuable if you are traveling in a remote area or unfamiliar with the surroundings.

Personal effects coverage provides protection for your belongings in the event of theft or damage. This coverage can be especially important if you are traveling with valuable items such as jewelry, electronics, or luggage.

Gap insurance covers the difference between the actual cash value of your rental car and the amount you owe on the rental agreement. This coverage can be beneficial if your rental car is totaled or stolen, as it can help you avoid being responsible for the remaining balance on the rental agreement.

Comparing Quotes

To make an informed decision when choosing rental car insurance, it’s crucial to compare quotes from multiple providers. This allows you to assess the coverage options, deductibles, premiums, and additional options available, ensuring you get the best value for your money.

Here are some tips on how to obtain quotes from different rental car insurance providers:

- Online comparison tools: Use websites or apps that allow you to compare quotes from multiple providers simultaneously.

- Directly from providers: Visit the websites of individual rental car insurance providers to get quotes.

- Insurance agents: Contact insurance agents who can provide quotes from different providers.

When comparing quotes, consider the following key factors:

- Coverage levels: Ensure the quotes provide the coverage you need, such as collision damage waiver (CDW), liability insurance, and personal accident insurance.

- Deductibles: Compare the deductibles, which represent the amount you pay out of pocket before the insurance coverage kicks in.

- Premiums: The premiums are the cost of the insurance policy. Compare the premiums to find the most affordable option.

- Additional options: Consider any additional coverage options, such as roadside assistance or personal effects coverage, that may be included in the quotes.

It’s essential to get multiple quotes to ensure you’re getting the best value for money. Comparing quotes allows you to make an informed decision and choose the rental car insurance policy that best meets your needs and budget.

Key Questions Answered

What are the most important factors to consider when comparing rental car insurance policies?

Coverage levels, deductibles, premiums, and additional options are the key factors to consider when comparing rental car insurance policies.

What are some common exclusions found in rental car insurance policies?

Common exclusions include damage caused by off-road driving, racing, or driving under the influence of alcohol or drugs.

What are some additional coverage options that may be available for rental car insurance?

Additional coverage options may include roadside assistance, personal effects coverage, and gap insurance.